For a good part of the year, Newsmax has been promoting its IPO stock offering to its readers and viewers in the hope of enticing viewers to buy in — CEO Christopher Ruddy even inserted the IPO into a discussion of the assassination attempt on Trump. There has been scant discussion, however, of the economic factors behind the IPO — Newsmax lost $42 million last year and faced a defamation suit from Smartmatic for spreading falsehoods about the company in the wake of the 2020 election.

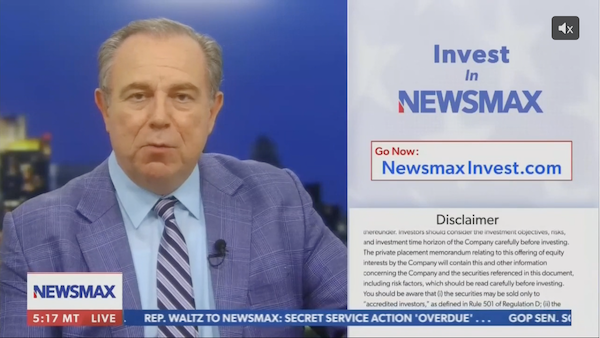

Still, the IPO hype continued apace. An Aug. 20 article touting the channel’s ratings also noted its “plans for a public offering in late 2024/early 2025.” Ruddy served up more hype in an Aug. 27 TV appearance:

Newsmax CEO Chris Ruddy appeared on “Rob Schmitt Tonight” touting the network’s big ratings success and the latest on its pre-IPO planned offering.

Nielsen data out this month shows July ratings made records for Newsmax — with the network drawing more than 22 million viewers to its cable news channel alone.

“We’re the only cable news channel in every day part seeing ratings increases, which is pretty amazing,” Ruddy told host Rob Schmitt last Friday.

“If you take CNBC, Fox Business, and NewsNation — combine them — we still beat them all in ratings and by a fairly good number,” Ruddy said.

Schmitt’s show detailed the network’s success as it has led cable news in ratings growth since 2023.

“We’re really excited by the level of engagement,” Ruddy said.

“The American people are voting with their remote controls in favor of Newsmax,” he said.

This was followed by a Sept. 4 article announcing that Newsmax “has confidentially filed with the Securities and Exchange Commission an offering statement and expects to conduct an initial public offering later this year or in early 2025.”

In September, Newsmax began hyping an “investor webinar” set for Nov. 21, in which Ruddy and Mark Elenowitz were to “discuss the company’s recent achievements, the benefits of making a Newsmax investment in the pre-IPO period and the impact of the 2024 election on the media landscape.” There was also a “news” article on the webinar that was just a barely rewritten press relesse.

Before that happened, Newsmax abruptly settled the Smartmatic lawsuit — but the terms were kept confidential, even though it is presumed that Newsmax paid a significant financial amount to Smartmatic, something has an impact on the financial viability of a company trying to launch an IPO.

Ruddy appeared on another Newsmax show on Oct. 18 to tout the IPO again, in which “Newsmax has raised $100 million of its planned $150 million for the private offering.” It appears, however, that the Smartmatic settlement was not mentioned, even though it’s a significant factor in Newsmax’s finances.

Newsmax also launched a website dedicated to promoting the IPO — but the Smartmatic lawsuit is not mentioned in either the FAQ or the investor slideshow. The only reference to it is in an amendment to the private placement memorandum on the IPO, in which Newsmax appears to confirm that it paid Smartmatic money to settle — and that part of the IPO proceeds will go to Smartmatic:

Newsmax Media reached a settlement agreement with Smartmatic on September 26, 2024, pursuant to which all claims will be released by Smartmatic for consideration, including a cash amount payable over time. Newsmax Media’s payment obligation with respect to this settlement is expected to be paid through the Company’s existing cash on hand, cash generated by the Company from current and future revenue, as well as proceeds from this offering and future equity offerings. See “Risk Factors – Risks Related to Legal and Regulatory Matters”. Management believes the settlement with Smartmatic will, subject to the payment of all consideration in a timely manner, reduce then eliminates future legal expenses the Company would have expected to bear related to this suit, which could have included costly appellate legal actions and other matters.

Newsmax also admitted that it could be in financial trouble if the court does not agree to the settlement:

The Smartmatic settlement agreement is subject to reaching a definitive settlement agreement that is approved by the court. If a final court-approved definitive settlement agreement is reached, the Company has agreed to make payments to settle all of Smartmatic’s legal claims. If a definitive settlement is not achieved, the Company intends to vigorously defend against the litigation. While Newsmax Media is vigorously defending such suits, an unfavorable outcome in this matter could have a material adverse effect on the Company’s financial position, results of operations and cash flows.

That appears to be an admission of how serious Smartmatic’s allegations against Newsmax were, how much money is involved — and how badly the company could be affected without this settlement. Still, Newsmax tried to keep up a good front. A Dec. 10 update from Ruddy gushed that “Newsmax has raised $125 million* in our Preferred 7% Convertible Share Offering.” and hyping the channel’s ratings. No mention of the Smartmatic settlement, of course.

UPDATE: Meanwhile, Forbes reports that Dominion’s lawsuit against Newsmax is still pending, with the trial set for April 2025.